- How different is comprehensive insurance from Compulsory Third-Party Liability (CTPL)?

CTPL, which is a requirement for any vehicle to be registered with the Land Transportation Office (LTO) in the Philippines, only covers legal liability for bodily injury or death arising from a vehicular accident. Meanwhile, comprehensive insurance, such as RideSure, is voluntary and has broader coverage.

- For how long is my motorcycle covered under RideSure?

RideSure covers your motorcycle for one (1) year from the time you have paid the corresponding premium.

- I have an old motorcycle, can I insure it?

No, RideSure covers even motorcycles up to five (5) years old.

- Can I insure my motorcycle if I use it for Angkas or other ride-sharing companies?

Yes. RideSure covers even motorcycles that are used for Angkas, Grab, Lalamove, or any other ride-hailing or delivery service.

- How much is my participation fee in case of a claim?

Only 1% of the value insured motorcycle, Minimum of PHP 500.

- How can I make a claim?

Simply email complete requirements to motorcycle.claims@pioneer.com.ph and we’ll settle your claim in cash.

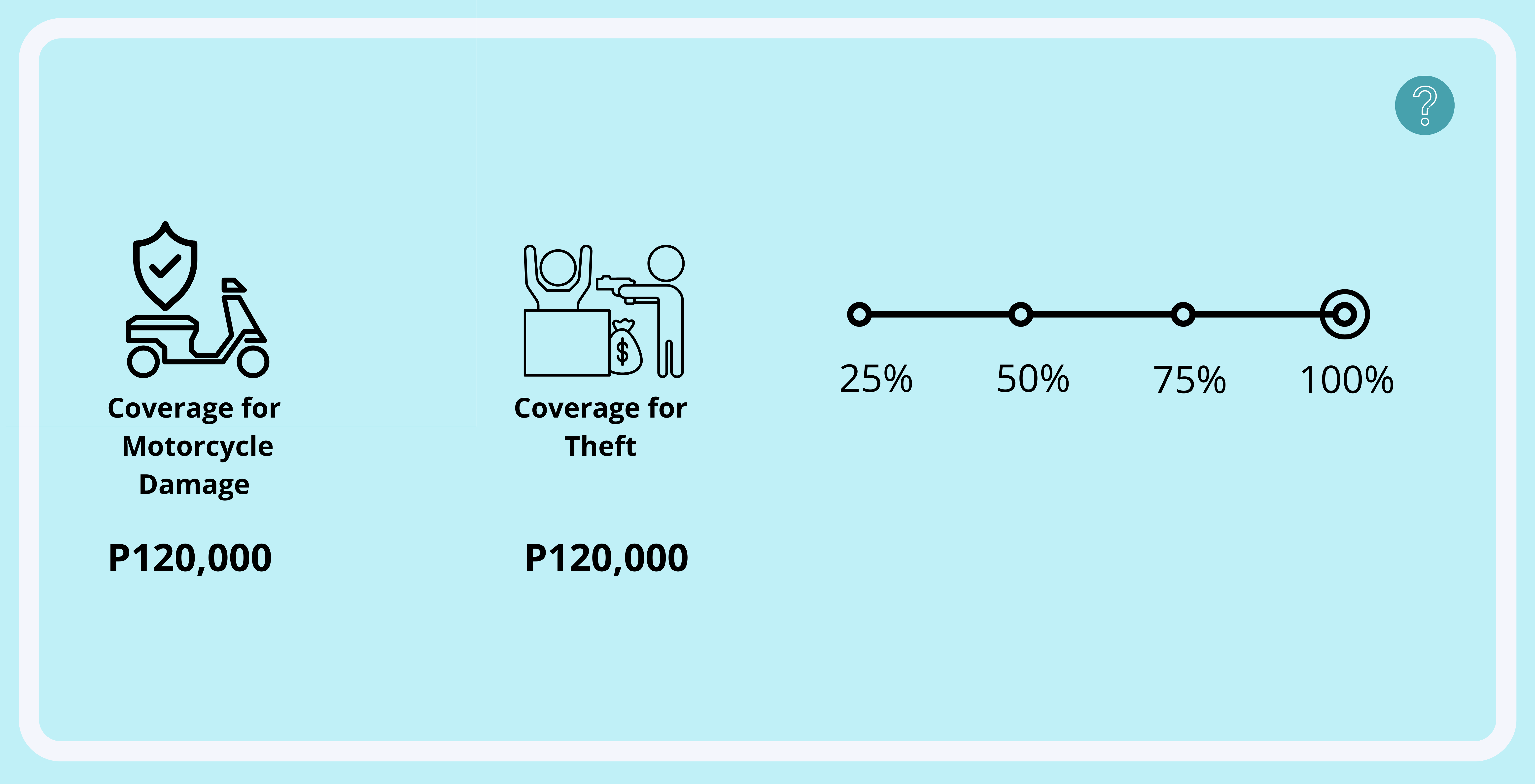

Motorcycle Damage: In case of damage to your motorcycle due to:

- Accidental collision or overturning,

- Fire, external explosion, self-ignition, or lightning

- Malicious act;

- While in transit (including the processes of loading and unloading) incidental to such transit by road, rail, inland waterway, lift, or elevator. This does not include coverage while a motorcycle is in transit aboard an inter-island vessel traveling in seas or oceans.

Theft: In case your motorcycle is stolen or carnapped

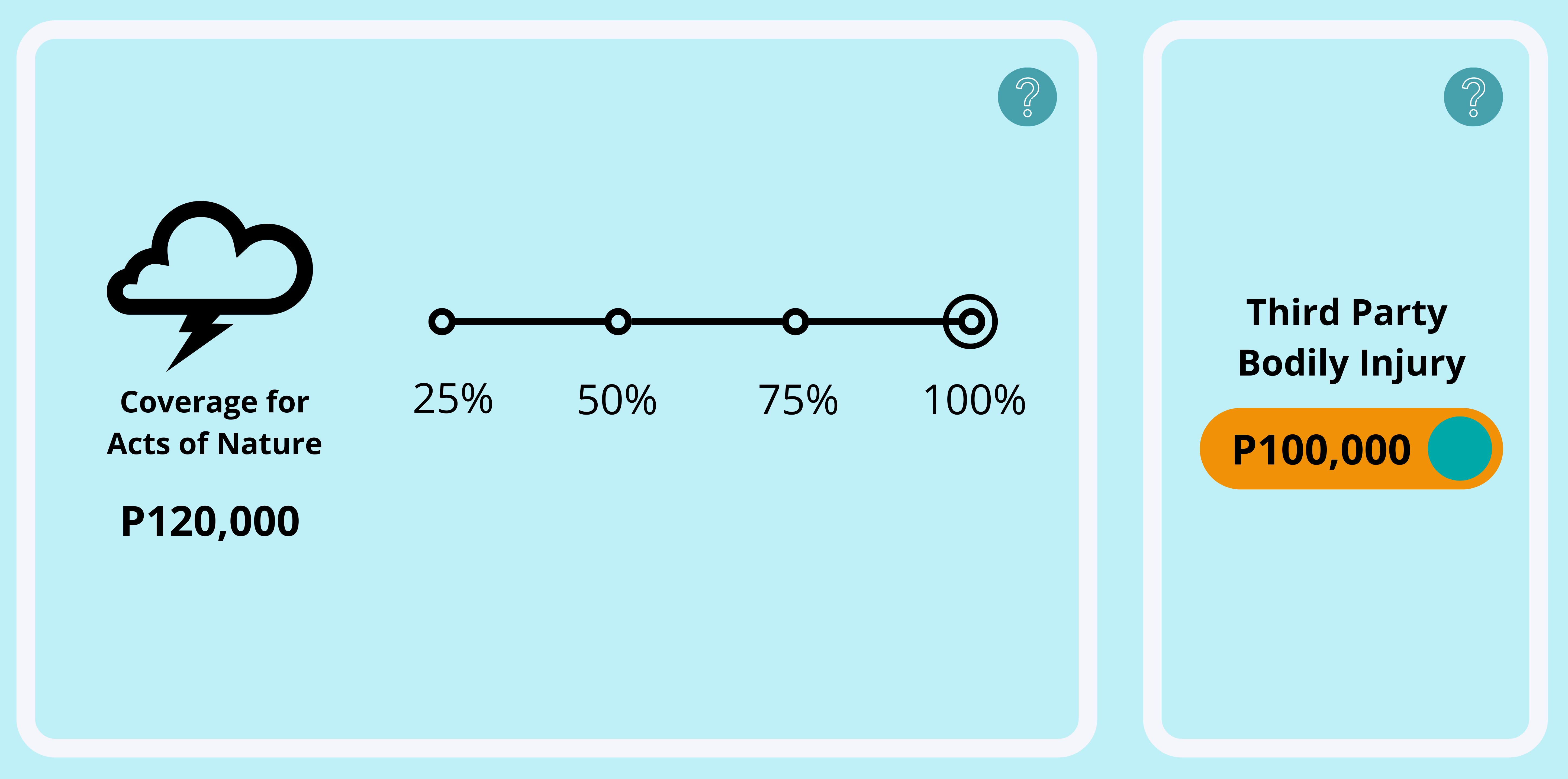

Acts of Nature: In case of damage to your motorcycle due to typhoon, flood, earthquake, volcanic eruption, and other natural calamities

Third Party Liability – Bodily Injury/Death: In case your motorcycle hits a person (other than the driver and the passenger), this benefit will respond as soon as the compulsory Third Party Liability (CTPL) insurance of the said motorcycle has been exhausted

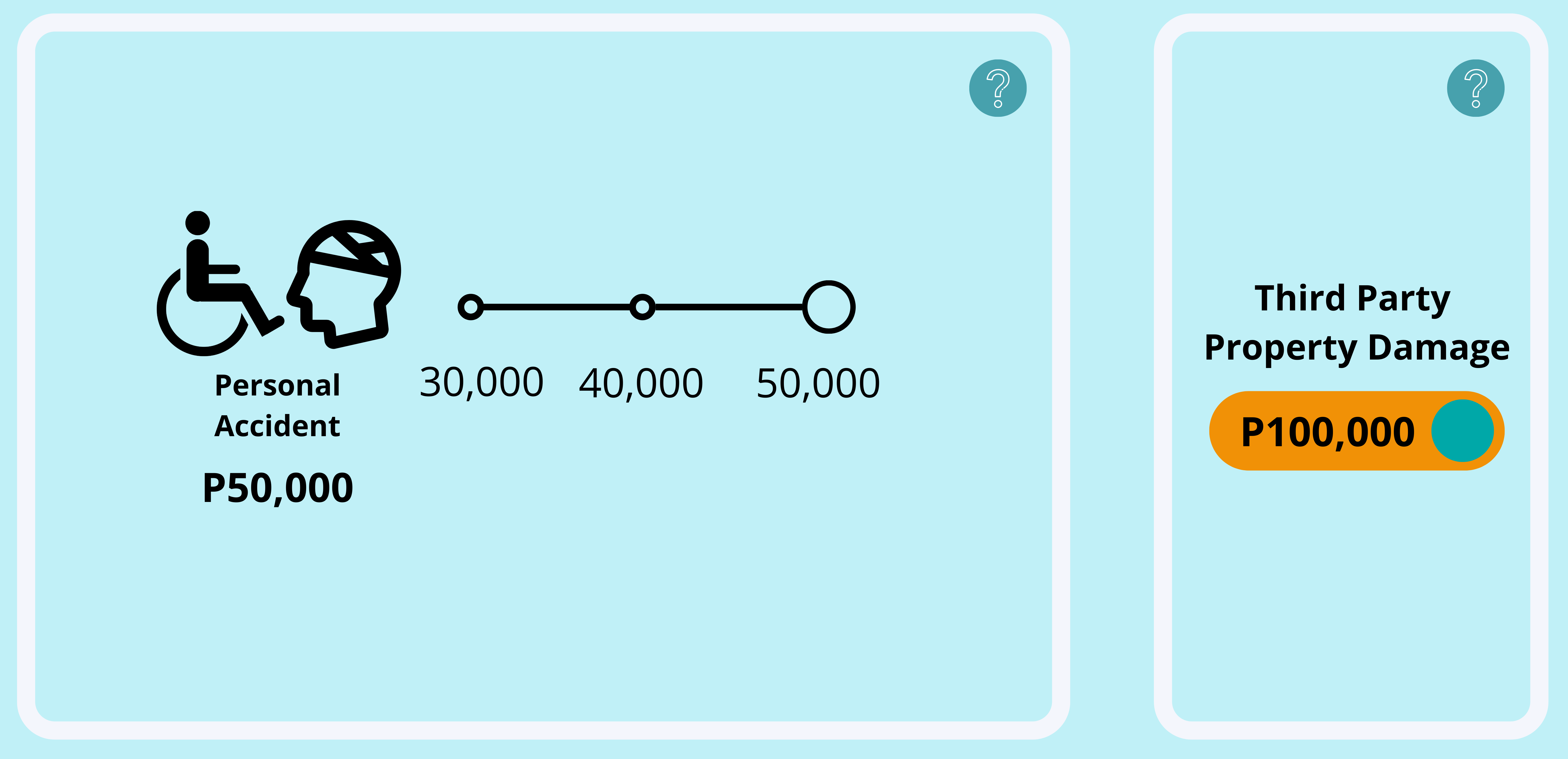

Third Party Liability – Property Damage: In case your motorcycle causes damage to another vehicle or property

Personal Accident: In case your motorcycle gets into an accident and causes bodily injury and/or death to the driver and/or passenger.